An Ocean of Words: Back in our July 2020 Investor Letter, we discussed the data analysis efforts we have been making during the COVID-19 fallout with an eye towards developing a framework to better understand how narratives evolve to affect people, markets, and economies. Since that time, we have taken that framework and begun developing a proprietary software stack to further refine our data collection/analysis process. Incremental progress in this area has led us to being able to proudly share some of our first meaningful insights from this system for the very first time.

Our Takeaways: In the sections to follow we will share some of our initial insights using the proprietary system we have named “Tratta”. Over the coming months, we will continue to add a variety of data sources and expand the capabilities of the system. Currently, the system looks at a variety of news sources - primarily financial in nature - such as The Wall Street Journal, Axios, and several others.

Tratta aggregates and analyzes text data from these various sources, and with that information, we are able to identify useful trends. Within our initial corpus of data, we only collected information going back to the beginning of this year. However, by feeding additional data streams into Tratta, we will be able to more rapidly contextualize our analysis rather than being solely reliant on a corpus of historical data.

As for our initial review, we implemented a variety of visualization techniques, but found Word Clouds, weekly instance, and month instance line graphs to be the most useful at the moment. We then ran a variety of word groups through our corpus of data and can now present some of our findings in the sections below.

No One Saw This Coming: The title of this section is a common trope that has been used, and perhaps over-used, to describe the novel coronavirus and the subsequent fallout. To many, at least in the U.S., COVID-19 mostly flew under the radar until March as more states began issuing some form of “state-at-home” orders. Even for our part, coronavirus was not mentioned in one of our investor letters until early March. However, a closer look (using Tratta as a lens) shows the topic was, at least quantitatively, gaining popularity much earlier than that. In the “Our Takeaways” section below is a series of Word Clouds starting with January and ending in March showing the growth in use of “coronavirus” relative to other Top 100 most frequently used words for that month.

Our Takeaways: While these word clouds contain a variety of seemingly random words, we would like to call attention to how the growth trends of certain words - particularly coronavirus - evolve over this four-month period.

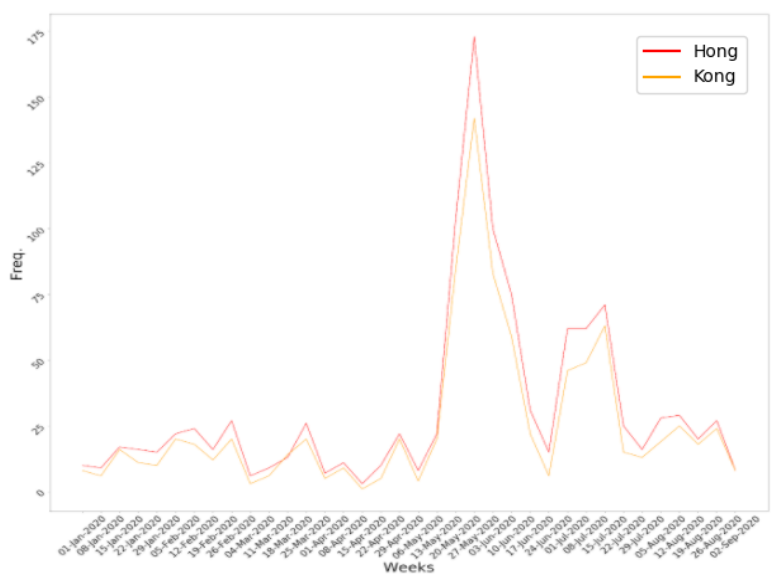

Flashpoint: Hong Kong has been the epicenter of, at times violent, protests that started back around March 2019 over a now rescinded extradition bill that many feared would expose Hong Kong residents to extradition to mainland China. This could have potentially exposed Hong Kong residents to the Chinese legal system, which historically has not been the case. The bill was thrown out in the face of the protests, but (to put things very broadly) general frustrations over the police and Chinese interventions in Hong Kong affairs fueled an acceleration of protests through the summer and into the Fall. Fervor began to dwindle going into 2020, and with the onset of COVID-19 in January/February large scale demonstrations went away for the most part. That is until May 21st when China announced it was drafting a new law that would be added into the Annex III of the Hong Kong Basic Law which effectively redefined what the Chinese government considered punishable acts against the central government. Known now more commonly just as the “national security law,” it was passed unanimously on June 30th without the full text ever being disclosed to the public. The chart featured in the Our Takeaways section below shows the weekly frequency of the words “hong” and “kong” from the beginning of January through early September.

Our Takeaways: As you can see in the chart below, mentions of these words were fairly stable throughout the beginning of the year with an abnormally large spike in the week prior to the May 21st announcement of the draft law. There is another pronounced bump just before the June 30th announcement of the law’s passage. While this example unfortunately does not have any direct market or economic inferences to be drawn, we expect to be able to apply similar time-series based analysis to identify noticeable upticks in keyword usage for other words/pairings that may help indicate more actionable market or economic trends

The Road to November: While we typically avoid making specific predictions concerning the political realm, one thing we were interested to see was how well our Tratta system, in its current state (i.e. primarily looking at financial news), could identify any insightful trends within the political sphere. More importantly, we wanted to see how the trends related to changes in candidate sentiment.

Unsurprisingly, and given the datasets bias towards financial news, Bloomberg (pink line) was mentioned with high levels of frequency going into the Super Tuesday primary on March 3rd. His name maintains a relatively high frequency of mentions even after he dropped out of the race. Some of this is likely attributable to his eponymous financial data firm, and some is likely attributable to the fascination with the tech firm, Hawkfish, that he seemingly founded in conjunction with his 2020 election campaign.

Also notable was the presence Bernie Sanders (yellow line) had over the other candidates going into Super Tuesday (with the exception of Bloomberg). Also of note, but certainly less surprising was the gain in frequency for Joe Biden (red line) coming out of the primaries at which point he had become the presumptive nominee.

What is more interesting, however, is how these gains become more exponential in nature going into August. This potentially has to do with the election being obviously closer, but another possibility is that Biden’s campaign was able to capture some substantial momentum when he finally named his running mate, Kamala Harris (orange line), in early August. Her mentions also received a notable uptick as well and outmatched anything she was able to achieve on the campaign trail in her bid for the presidency. All in all, this seemed to quantitatively represent how the election has unfolded on the Democratic side of things (at least from the financial media’s perspective). In the future, we expect to be able to conduct similar group style analysis to gain further insights into the favorability/brand recognition of say companies in a highly competitive industry. These insights could be then overlaid with market performance to determine if such characteristics are outcome determining factors for firms’ financial performance.

DISCLAIMER: We only work with accredited investors and qualified purchasers that know at least one of the Managing Partners. This website is provided for informational purposes only. None of the information available on the website (the "Website Information") constitutes an offer to sell, or a solicitation of an offer to buy, any interest in any entity or other investment vehicle offered by Gold Sail Capital LLC or any of its affiliates (collectively, "Gold Sail"). Any such offer or solicitation will be made to accredited investors only by means of a final offering memorandum. The Website Information should not be deemed as a recommendation to buy or sell interests in any entity or security. Gold Sail cannot and does not guarantee the success of any investment. Past performance is not indicative of future results and no assurance can be made that profits will be achieved or that substantial losses will not be incurred. All investments involve risk and loss of capital. Gold Sail reserves the right to change, modify, add or remove portions of any content posted on the website at any time without notice and without liability. Our Terms, Disclosures, & Privacy Policy govern your use of our website; by using our website, you accept the Terms, Disclosures, & Privacy Policy in full. If you disagree with any part of the Terms, Disclosures, & Privacy Policy, then do not use our website.